October 1st is here, so the third quarter of 2016 is now history. Seems like a good time to review some things – like Ontario’s move towards world leader status in the curtailment of potential supply from wind turbines – mostly paid whether or not their output can be handled by the grid.

Over the first 3 quarters, I estimate curtailment of supply from industrial wind turbines is three and a half times greater than the same period in 2015 – and 14 times higher than in 2014.

The kicker here is that the greatest period for curtailment in the past has been the fourth quarter.

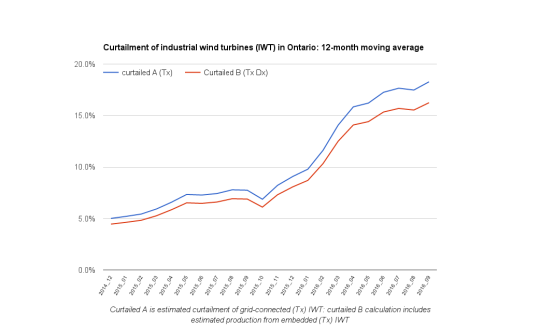

Curtailment data is difficult to find (which is why I produce it), but increasingly of interest across the world. China is often noted for high curtailment – one report shows 21% of all potential generation in that country curtailed in the first half of 2016.

It’s difficult to compare jurisdictions, but Ontario seems to be chasing China for lowest utilization of potential wind output. Depending on whether or not calculations included estimated distribution-connected turbines (which we have little reporting on in Ontario, but expect can’t be curtailed), I have the 12-month running average curtailment levels at 16-18.3%, and I expect that to rise rapidly until cold sets in.

A warm December and Ontario could set a record for annual wind curtailment levels.

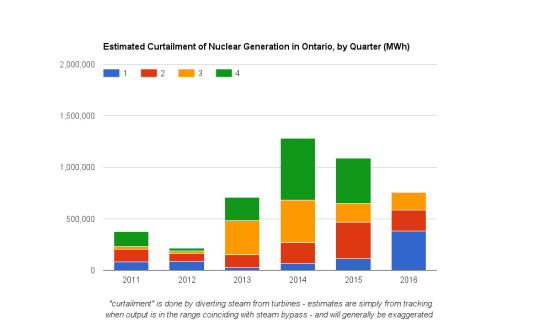

The system operator only provides occasional reporting on a couple of types of curtailment – primarily wind and nuclear. For 2016, the curtailment order was changed, which does explain some of the increase in the curtailment of output from industrial wind, but I have not seen a corresponding decrease in the curtailment of nuclear units.

Ontario Power Generation (OPG) reports on the impact of the province’s electricity supply surplus on its hydro facilities in quarterly reporting. My understanding is this is not specifically curtailed by the system operator, which would explain why that entity never shows the impact. However, the market design limits OPG’s hydro production when Surplus Baseload Generation (SBG) conditions exist.

From OPG’s 2nd quarter report:

During the six months ended June 30, 2016, OPG lost 3.4 TWh of

hydroelectric generation due to SBG conditions, compared to 1.5 TWh during the same period in 2015.

The 3.4 TWh (million megawatt-hours) is particularly striking as OPG previously reported, “During each of 2015 and 2014, OPG lost 3.2 TWh of hydroelectric generation due to SBG conditions.”

Late in September Ontario’s government suspended programs to procure more supply from “renewable” sources (including waste), claiming the move would “save up to $3.8 billion” painlessly, as “No additional greenhouse gas emissions are being added to the electricity grid.”

While this is something of a recognition of the surplus generation situation, the government did not act on contracted projects that are yet to receive a notice to proceed (NTP). According to the system operator’s Contract List, not only are there over 1,000 megawatts of industrial wind turbine capacity in this group, above half of that was contracted over 5 years ago with feed-in tariff contracts designed to get generators into service within 3 years.

You say “I have not seen a corresponding decrease in the curtailment of nuclear units.”

OK the reduction in nuclear curtailment doesn’t match the wind curtailment but perhaps hydro curtailment is also reduced?

LikeLike

But I note it isn’t Ike – it’s up. One difference was a mild winter compared to a very cold one in 2014, but a lot of it is just growing wind unnecessarily in what has become an extremely poor supply mix.

LikeLike